Percentage of federal tax withheld from paycheck

You can request an additional amount withheld from each paycheck. Each allowance you claim reduces the amount withheld.

Federal Income Tax Fit Payroll Tax Calculation Youtube

The last minute federal tax legislation extending 2010 tax ratesbrackets into 2011 has been incorporated into this release.

. What is the percentage of federal income tax withheld. Use the Electronic Federal Tax Payment System EFTPS to deposit the taxes electronically. You must specify a filing status and a number of withholding allowances on Form W4.

You claimed exempt on your W-4. X 062 current Social Security tax rate 310 Social Security tax to be deducted from employees paycheck Further reading. The impact on your paycheck might be less than you think.

State taxes are withheld as a fixed percentage of Federal taxes. Additional amount if any you want withheld from each paycheck. This is the simpler method and it tells you the exact amount of money to withhold based on an employees taxable wages number of allowances marital status and payroll period.

You pay the tax as you earn or receive income during the year. If you have too much tax taken out of your paycheck you will receive a refund but in the meantime youre giving the government an interest-free loan. Employers withhold FIT based on a percentage of the employees salary use a bracket method or alternative method to determine how much FIT tax to withhold.

The employee can earn a. Nonpayroll federal income tax withholding reported on Forms 1099 and Form W-2G Certain Gambling Winnings must be reported on Form 945 Annual Return of Withheld Federal Income Tax. Reporting federal income tax.

The actual amounts depend on your income and filing status. Withholding tax is income tax withheld from employees wages and paid directly to the government by the employer and the amount withheld is a credit against the income taxes the employee must pay. Employers whose enterprises are covered by the FLSA or who have employees engaged in interstate commerce are required by the FLSA to pay the minimum wage and therefore.

This is the simplest method so chances are your employer most likely will withhold the percentage from your bonus. Emergency increase in unemployment compensation benefits. Separate deposits are required for payroll Form 941 or Form 944 and nonpayroll Form 945 withholding.

Bb taxes imposed or withheld under chapters 21 22 or 24 of the Internal Revenue Code of 1986 during the covered period. The amount of federal income tax withheld from your pay is determined by federal tax withholding tables and rates. Percentage of federal tax plans.

If you do not make your deposits on time you may have to pay a penalty. Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. You paycheck typically includes withholding for federal income taxes Medicare and Social Security taxes state income taxes and in some cases municipal income taxes.

While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding. The federal income tax is a pay-as-you-go tax. Last year I had a right to a refund of all federal income tax withheld because I had no tax liability and.

6 to 30 characters long. The TCJA eliminated the personal. Your Form W-2 will show your total wages and withheld income tax for the year.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. Federal income tax is based on the employees filing status number of allowancesexemptions earnings and the IRS withholding tax tables. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

On your tax return you report the wages and withheld income tax for the period before you filed for bankruptcy. If you have too little tax withheld youll end up having to send the IRS a check when you file your taxes and for many people thats a true hardship. For high income taxpayers in the AMT the.

If you filed for bankruptcy under chapter 11 of the Bankruptcy Code you must allocate your wages and withheld income tax. The IRS says all supplemental wages should have federal income tax withheld at a rate of 22. Nonpayroll items include the following.

You should write Stop Payment on the check and return the original paycheck to the Payroll department. If you have a large number of deductions your employer might withhold more money than you actually owe. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit.

6 7 I claim exemption from withholding for 2019 and I certify that I meet both of the following conditions for exemption. Temporary full Federal funding of the first week of compensable regular unemployment for States with no waiting week. Must contain at least 4 different symbols.

Finally you can make any needed tax adjustments for dependents and determine the amount of tax per check. Figure the tentative tax to withhold. Updated all spreadsheets to account for the itemized deduction and personal exemption phase-out limitation percentage from 23 to 13 based on the 2008 tax law change.

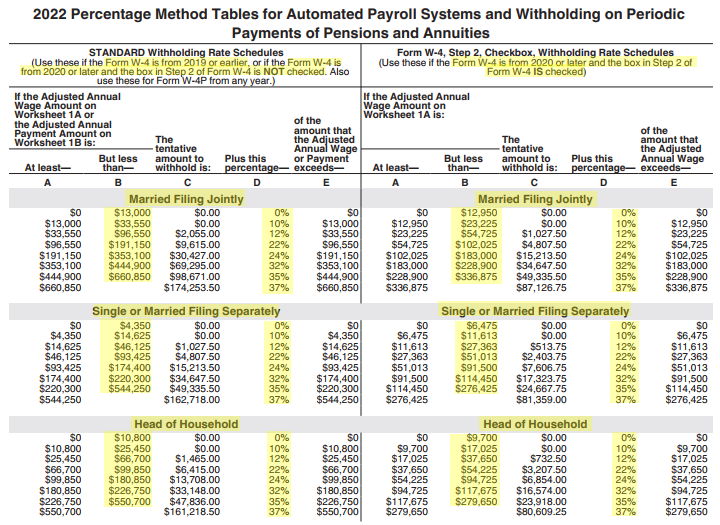

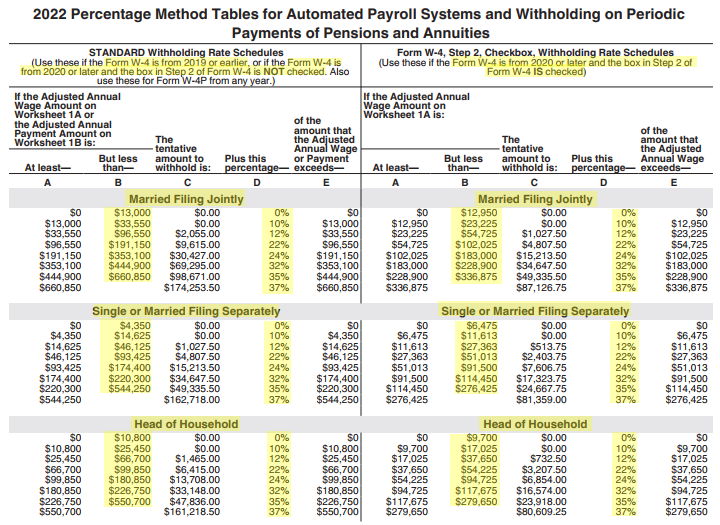

There are two federal income tax withholding methods for use in 2021. In the case of a payer using the new 2022 Form W-4P a payee who writes No Withholding on the 2022 Form W-4P in the space below Step 4c shall have no federal income tax withheld from their periodic pension or annuity payments. Wage bracket method and percentage method.

No as employee you do not have to earn a minimum income for federal and state income tax to be withheld. If this is the case the federal solar tax credit will be added to your tax refund check. FIT Tax refers to the federal income tax that is withheld from a W-2 employees payback on every payday.

If you owed 8000 in taxes but 10000 was withheld from your paychecks youd be getting a 2000 tax refund from the government. To claim exempt you must. But only the amount up to what you owed.

There is no maximum limit on this portion of the tax. A separate payroll tax of 145 of an employees income is paid directly by the employer and an additional 145 deducted from the employees paycheck yielding a total tax rate of 290. You need to report how much federal income tax you deposit.

Federal income taxes also wont be withheld from your paycheck if you claimed exempt on your W-4. While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. Choosing not to have income tax withheld.

As an employer you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal state and local tax authorities. To do this use either Form 941 or Form 944. Now that you know what is FIT withheld on paycheck good luck in.

Since a variety of federal laws cover the different types of deductions that can be made from your paycheck whether your employer is covered depends on which law is at issue. All these factors determine the employees federal income tax withholding amount. So for a 10000 bonus youd have 2200 withheld in federal income taxes and receive 7800.

ASCII characters only characters found on a standard US keyboard. The Withholding Form. Account for dependent tax credits.

Paycheck Calculator Online For Per Pay Period Create W 4

Understanding Your Paycheck

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Quiz Worksheet Federal Income Tax Withholding Methods Study Com

Solved W2 Box 1 Not Calculating Correctly

Payroll Tax What It Is How To Calculate It Bench Accounting

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Powerchurch Software Church Management Software For Today S Growing Churches

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

Calculating Federal Income Tax Withholding Youtube

How To Calculate Payroll Taxes Methods Examples More

Irs New Tax Withholding Tables

How To Calculate Federal Income Tax

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

How To Calculate Federal Withholding Tax Youtube